Ecos Mobility IPO, a rapidly growing player in the electric vehicle (EV) sector, has made headlines with its upcoming Initial Public Offering (IPO). As a company that has positioned itself as a leader in innovative mobility solutions, the Ecos Mobility IPO is attracting considerable attention from both retail and institutional investors. With a focus on sustainable transportation and cutting-edge technology, Ecos Mobility’s public offering marks a significant milestone in the company’s growth trajectory. In this comprehensive guide, we explore the Ecos Mobility IPO in detail, including its subscription status, Grey Market Premium (GMP), and investment potential.

Overview of Ecos Mobility

Ecos Mobility has emerged as a disruptive force in the electric vehicle market, specializing in advanced battery technologies and sustainable transport solutions. The company has garnered attention for its innovative approach to mobility, integrating smart technology with eco-friendly practices. Headquartered in a tech hub, Ecos Mobility’s strategic partnerships with global giants in the automotive industry have solidified its reputation as a company to watch. The IPO is aimed at capitalizing on the booming demand for electric vehicles and enhancing the company’s production capacity and technological capabilities.

Key Details of the Ecos Mobility IPO

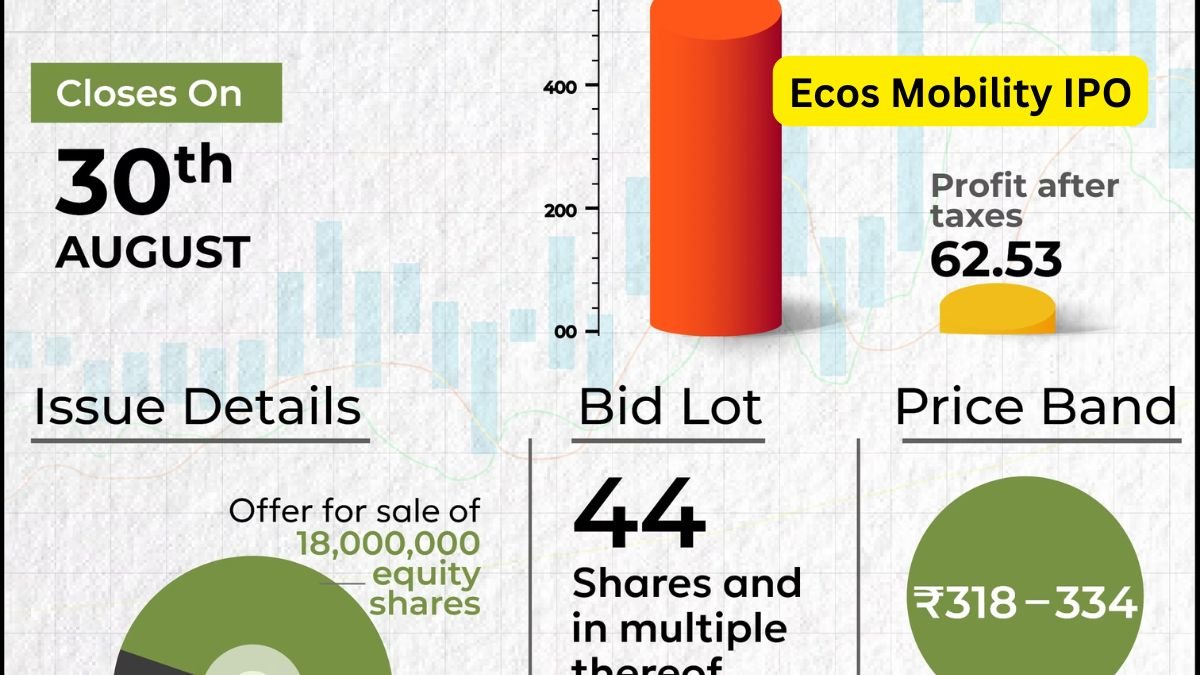

- IPO Opening and Closing Dates: The Ecos Mobility IPO opened for subscription on August 28, 2024, and will close on August 30, 2024.

- IPO Price Band: The price band for the IPO has been set between ₹80 to ₹85 per share.

- Lot Size: Investors can bid in lots of 150 shares, with a minimum investment amounting to ₹12,000.

- IPO Size: The total size of the IPO is expected to raise approximately ₹200 crores, which includes both fresh issue and an offer for sale by existing shareholders.

Ecos Mobility IPO Subscription Status

As of the third day of the IPO, the subscription status indicates a strong interest from various investor segments:

- Qualified Institutional Buyers (QIBs): Subscribed 2.15 times

- Non-Institutional Investors (NIIs): Subscribed 1.78 times

- Retail Investors: Subscribed 5.42 times

The robust subscription numbers reflect confidence in Ecos Mobility’s business model and growth prospects. With retail investors showing overwhelming interest, it indicates a promising start for the company’s journey as a publicly traded entity.

Grey Market Premium (GMP) Analysis

The Grey Market Premium (GMP) for the Ecos Mobility IPO is an essential factor for investors considering whether to apply for the shares. As of the latest data, the GMP is approximately ₹15-18 per share, which indicates a positive outlook from the grey market. This premium suggests that there is strong demand for Ecos Mobility shares even before they are officially listed on the stock exchange. A higher GMP is often considered a bullish sign, reflecting market confidence in the company’s future growth potential.

Ecos Mobility’s Financial Performance

Understanding the financial health of Ecos Mobility is crucial for assessing its IPO. The company’s financial statements reveal consistent growth in both revenue and profit margins over the past few years:

- Revenue Growth: The company reported a compound annual growth rate (CAGR) of 35% over the past three years.

- Profit Margins: Ecos Mobility has maintained a healthy profit margin of around 20%, with a net profit of ₹40 crores in the last fiscal year.

- Debt-to-Equity Ratio: The company has a low debt-to-equity ratio, indicating prudent financial management and a strong balance sheet.

These financial metrics suggest that Ecos Mobility is well-positioned to leverage its IPO proceeds to expand its operations and invest in new technologies.

Use of IPO Proceeds

The funds raised from the IPO will be primarily utilized for the following purposes:

- Expansion of Manufacturing Facilities: Ecos Mobility plans to enhance its production capacity by setting up a new manufacturing unit focused on EV battery production.

- Research and Development (R&D): A significant portion of the IPO proceeds will be allocated to R&D activities aimed at developing next-generation electric vehicles and autonomous driving technology.

- Debt Repayment: The company intends to use a part of the proceeds to reduce its existing debt, thereby improving its financial stability.

- General Corporate Purposes: Additional funds will be used for general corporate purposes, including marketing and expansion of the company’s sales network.

Should You Apply for Ecos Mobility IPO?

Investing in the Ecos Mobility IPO presents a potentially lucrative opportunity, especially given the strong demand in the electric vehicle market. However, prospective investors should consider the following factors:

Strengths of Ecos Mobility

- Strong Market Position: Ecos Mobility has established itself as a key player in the EV market, with a focus on sustainability and innovation.

- Robust Financials: The company’s healthy profit margins, revenue growth, and low debt-to-equity ratio underscore its financial stability.

- High Growth Potential: With plans to expand manufacturing and invest in R&D, Ecos Mobility is poised for long-term growth.

Risks to Consider

- Market Volatility: The EV sector is highly competitive and subject to market fluctuations. Regulatory changes and technological advancements could impact Ecos Mobility’s growth prospects.

- Execution Risks: The success of the company’s expansion plans depends on its ability to effectively manage its new projects and investments.

Expert Recommendations

Analysts generally have a positive outlook on the Ecos Mobility IPO, citing its growth potential and strategic market positioning. However, investors should consider their risk tolerance and investment horizon before making a decision. It is advisable to diversify one’s portfolio and consult with a financial advisor to align investments with individual financial goals.

Conclusion

The Ecos Mobility IPO is an exciting opportunity in the electric vehicle sector, backed by a company with strong financials and ambitious growth plans. With substantial investor interest and a promising Grey Market Premium, it holds significant potential for those looking to invest in sustainable mobility solutions.

In this blog, we have provided detailed information on Ecos Mobility IPO. We appreciate you taking the time to read this post about Ecos Mobility IPO in our blog! If you find this information useful, please share this blog with your friends and family so that they can also know about Ecos Mobility IPO. Visit our website homepage weblog365.in to read more interesting and informative blogs and stay updated.

My name is Yogesh Pandey, and I hail from Lucknow, India. I work in digital marketing. I have been blogging since 2023. I write about Technology, Entertainment, Automobile, and Lifestyle providing insights to help others find quality products. I am excited to have the opportunity to collaborate with weblog365.in now. You can reach out to me via email at weblog365.in@gmail.com. Let’s connect! 🙏